By OcJim

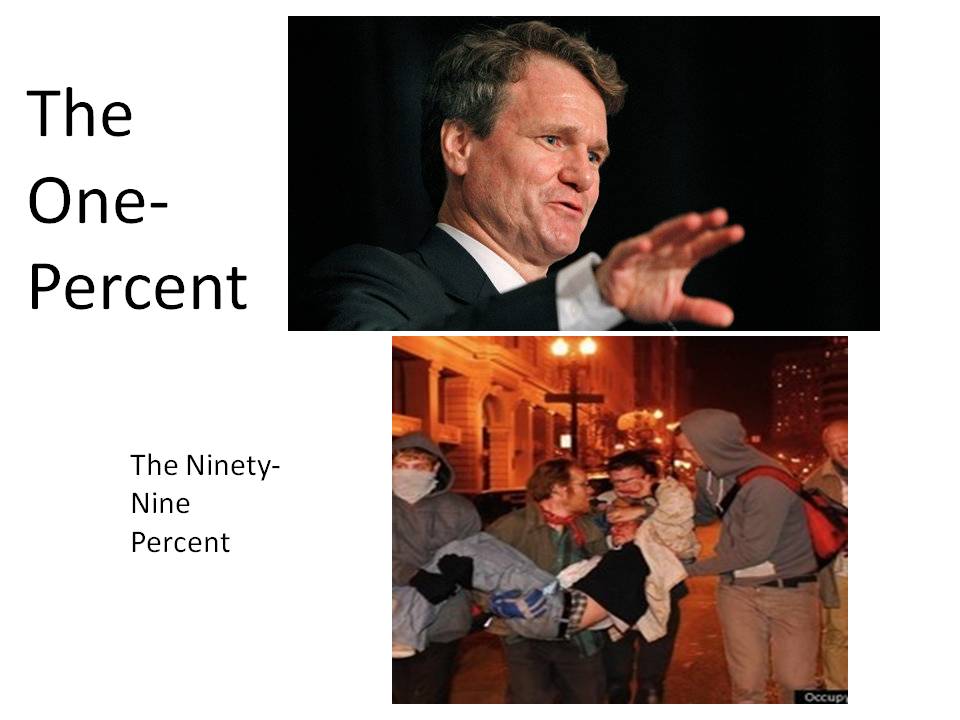

In full riot gear, a phalanx of several hundred police – Oakland, state, and neighboring communities — violently dispelled peaceful Oakland participants of the Occupy Wall Street movement in the early dawn hours of Tuesday morning and again Tuesday night, using tear gas canisters, rubber bullets and explosives (euphemistically called flash-bangs) within the crowd. One demonstrator is in critical condition with a fractured skull, reportedly hit by a tear gas canister.

Now this is the treatment that a peaceful, lawful assembly representing the 99% gets. What kind of treatment does the 1% get, many of which led us into the worst downturn since the Great Depression, a downturn that dried up jobs, severely depleted 401Ks employees depended on for retirement, exported millions of jobs, led to massive layoffs of teachers and police, and dispatched mostly Republican agents to blame the government and labor unions?

One of the poorest “one-percenters,” who only takes in some $7 million in compensation per year, thinks he is undergoing hardship. Bank of America CEO Brian Moynihan imperiously says the public needs to start thinking before they criticize his company:

“I, like you, get a little incensed when you think about how much good all of you do, whether it’s volunteer hours, charitable giving we do, serving clients and customers well,” Moynihan said to employees in a global town hall meeting last week, Bloomberg reports. “You ought to think a little about that before you start yelling at us.”

Bank of America got $30 billion from the Troubled Asset Relief Program (TARP) taxpayer bailout for itself and another $15 billion through Merrill Lynch, which it took over, bankrupt and fraud-ridden (accused of stock, securities, and investor fraud). Along with monoliths Wells Fargo, Citigroup, Goldman Sachs, and JP Morgan, it whined until the federal government relaxed 3-yr-repayment TARP regulations, allowing them to repay their loans early in June of 2009, thus removing other TARP regulations. The deal made with TARP regulators was not widely understood.

From the beginning, most banks receiving TARP funds, including B of A, never did fully abide by TARP regulations, especially covering foreclosure property. Banks were supposed to gather information from the homeowner, and offer a revised three-month payment plan for the borrower. If the homeowner makes all three payments under the trial plan, and provides the necessary documentation, the lender must offer a permanent modification.

All whiners had received more than $25 billion in bailouts. Their stated motive was the stigma attached to owing the government, but the apparent real motive was being able to pay millions in bonuses to executives who failed the people, including consumers, customers and investors. Indeed, this was about the same time all TARPers were being criticized for using tax money to pay lobbyists to oppose financial regulation, which turned out to be pretty weak in the Dodd-Frank Bill.

What is important is that many of the largest banks recovered easily after participating in and buying up nearly worthless subprime paper that our government backed. Executive elites of Bank of America disingenuously overpaid to absorb defaulted Countrywide and acquired their CEO Moynihan through the imperiled Merrill Lynch’s takeover. Recently Merrill Lynch, B of A’s “Wealth Management Division,” paid a paltry $10 million to settle a fraud accusation by the SEC.

Bank of America suspended foreclosures when accused in several states of foreclosing without documentation of ownership, but did resume after a short review. Suit lawyers doubted that ownership was clarified. Further taking money out of taxpayer pockets, Bank of America, and other foreclosers, do harm to property owners near slow-moving, mostly ill-kept foreclosure property owned by big banks, bringing down their property values because of the eyesore property belonging to banks.

Banks have proven to be slow investing in a recovery and helping those foreclosed, not to speak of heavy-handed mistakes of foreclosing property already paid for. It is not the magnanimous picture that CEO Moynihan painted in his comments, but quite the contrary.

Many Americans are coming to the conclusion that they can participate in Occupy Wall Street by using their own weapon. In reaction to TARP-bank-escapades, to increasing fees, curtailed services, and unethical foreclosure practices — not to speak of arrogance, transfer checking accounts from TARP banks, having overpaid CEOs, banks like Wells Fargo, Bank of America, Citibank, or JP Morgan-Chase to smaller banks (USAA is nationwide and ethical, for example).

This can be as effective as activists occupying public areas, and you would undergo less risk of being beaten by overzealous police under pressure from the “one-percenters.”

Transferring funds of $2,000 by 1 million people, for example, amounts to a total of $2 billion with the potential of some $20 billion in loans that banks would lose – chicken feed compared to TARP loans, but still substantial.

Should we go for it?