By OcJim

The prospects for Americans after the next election are not good, regardless of who wins the next election, unless we see total victory of Democrats, which is quite unlikely. If money continues to dominate elections, there is little reason to believe that survival instincts of both Republicans and Democrats won’t kick in, deeming the interests of the poor and the middle class totally secondary to the rich.

Politics is a calculating endeavor, a give-and-take game in which you give and take away, depending on which group of voters has the means to vote you in or out. Generally for Republicans the favor goes to the rich, for Democrats, to the middle class, though their commitment to the middle class is weakening, as the rich, armed with unlimited money, provide candidate campaign support.

Another fly in the ointment of potential chaos is the Bush tax cuts. If they expire for everyone it could mean an increase of some 500 billion in revenue, but would dampen the economy and jobs, impacting some 5% of the GDP. It is not likely that Republicans would let them expire just for the rich. There is no way to predict, so Bush tax cuts will be ignored.

What will our two candidates do over the next four years if elected: Romney and Obama?

Obama will implement the Affordable Care Act (ACA) which will provide affordable health care for some 28 million Americans who don’t already have it, not allow health care providers to cancel for pre-existing conditions, provide the under 26 crowd with parental coverage. Obama has professed support of extending the Bush tax cuts for those making less than $250,000 and letting them go up for those making more. He would raise the ceiling for FICA payroll deductions to $250,000 from the current $106,800 and keep social security as it is. Medicaid funding, food stamps and Head Start would continue, assuming a large (filibusterless) majority in the Senate. Will increase infrastructure spending, extend unemployment benefits, initiate programs for returning veterans, and implement job training.

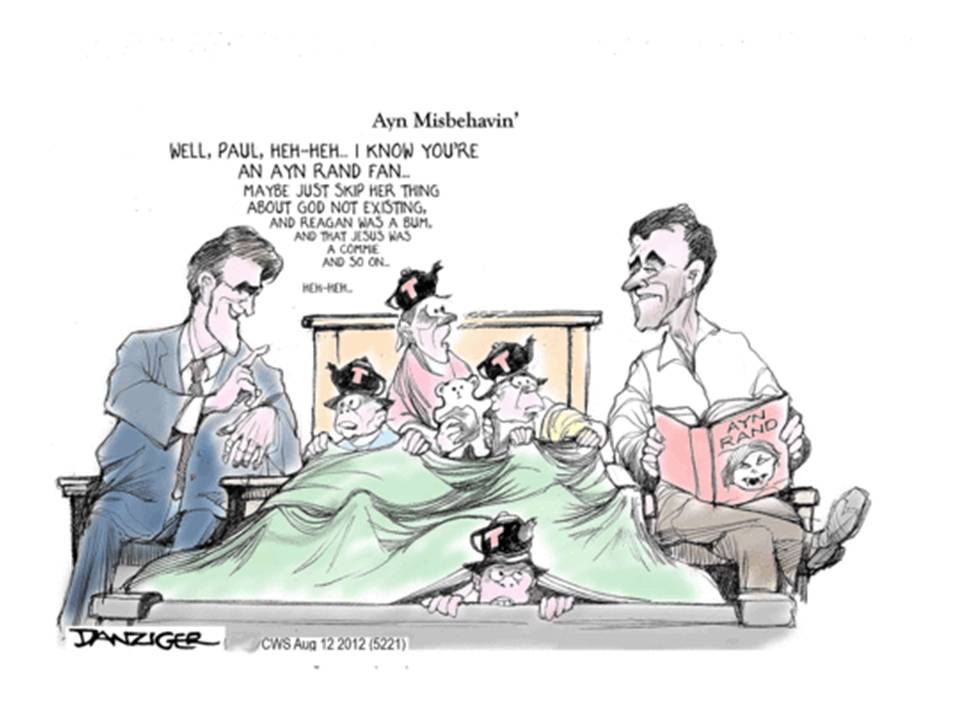

Romney would repeal ACA. He would increase the size of the military by 100,000 troops. He would expand the naval armada by $40 billion. He opposes ratification of a bilateral nuclear arms reduction treaty. His support of John Bolton for Secretary of State generally portends a chicken hawk stance in foreign affairs and possibly a war with Iran. Secretive, with even murkier budget plans, Romney likes those of Paul Ryan.

He pledged support of Ryan’s budget which would provide a voucher system for under-55 year old Americans (the latest plan giving them a choice to stay with the old with restrictions if you do). A non-partisan source, Tax Policy Center (TPC), reports that Romney tax plans would raise taxes for the middle class by as much as $2000 average and add more than $3 trillion to the federal deficit, while reducing taxes for the rich.

The TPC assessed a 10 year $4.3 trillion revenue loss from Paul Ryan’s cuts in taxes for the rich. About $1 trillion of the revenue loss would be offset by investment cuts in the poor: cut Medicaid = $800 billion, cut food stamps = $130 billion, and other cuts which include aid to college students at $70 billion. Then Ryan includes the $716 billion in Medicare savings that repealing ACA would bring, although a dishonest calculation. Overall we have $4.3 going to the rich, offset by $1.7 trillion taken from the poor.

Both Romney and Ryan favor privatization of social security, making it more a casino-type venture. Romney has promised to drop funding for Planned Parenthood. He is against extension of unemployment benefits. He supports a balanced-budget amendment. He is for the Keystone Pipeline and against support of wind energy but for nuclear energy. He generally opposes regulations of environmental pollution and of financial institutions.

Given that empirical wisdom, we can generally calculate who will gain and who will lose, by age and income, in the event of total victories for the presidency and Congress either for Republicans or for Democrats. Realistically, it is not likely that there will be total victories for either side. Given the predominant forces favoring the rich, we cannot go much beyond the next presidential election. The percent up or down numbers reflects the change in the group’s well being, measured in terms of health, income, education, opportunity, and wealth. It is only a subjective estimate based on proposed policies and past performance of the two parties.

| Category | % of Well Being: Up/Down | % of Well Being: Up/Down | Comments apply mostly to a Republican takeover. Assume a Democratic majority would hold social spending to the same level or slightly less. |

| Age | Republican | Democrats | |

| Under 18 | Down 20 | same | Head Start for preschool will go away. Education funds will dry up as the Dept of Education is slowly choked of money and significance. All early child support funds will fade or die. Medicaid choked for poor. |

| 19 – 26 | Down 15 | Up 3 | Higher education will have no priority. Student loan interest will rise, taken over by banks. |

| 26 – 54 | Down 15 | Up 5 | Jobs will pay less. Unemployment benefits will dry up and job funds will be squeezed. Health Care costs will go through the roof as Republicans repeal ACA. More of the poor will be homeless and sick as Medicaid is cut, rendering millions w/o health care. |

| 54 and older | Down 8 | same | Voucher not applied to this age group but Medicaid cuts will insure that seniors who run out of money can’t get long term care under Medicaid. Children of old who need long term care will have to take in the sick and disabled who’ve run out of funds. |

| Income | |||

| Under 50,000 | Down 15 | same | Military spending increase will ignore needs of the poor who don’t vote in large numbers. Many don’t own homes for interest and tax deductions which will be phased out anyway. Payroll taxes will increase as taxes grow more regressive. Medicaid, ACA, food stamps and shelter support will go away. |

| 50,001 to 100,000 | Down 9 | Up 4 | Family deductions will mostly likely disappear as the rich pay fewer taxes. Health care will eat up costs as coverage becomes more problematic. Those unemployed will stop getting benefits. |

| 100,000 to 300,000 | Down 7 | Up 5 | Burdens of education, childcare services, and home ownership felt more as health care, education and tax supports disappear. |

| 300,001 to Million | Up 13 | Down 3 | Income taxes most likely reduced for upper level earners while tax shelters more available for affluent. |

| Millionaire and beyond | Up 18 | Down 5 | Republicans, cuts in social programs will have no consequences. Millions gained by reduced taxes will not affect consumption as America experiences stagflation with high joblessness, high food prices, and drought due to climate change. |

Assumptions made differentiate Obama stimulus spending with the Romney’s trickle-down approach. It assumes Obama’s continuation of low-interest college loans which Romney opposes, extension of unemployment benefits which Romney opposes, Obama’s pursuit of tax increases for those making more than $250,000 per year, and Obama funding for food stamps. It sees an implementation of ACA, and more revenue-sharing with states for education, health, and local fire and police protection, as well as infrastructure spending.

All these assumptions are in line with policy statement on both sides.